Oil switched between gains and losses after Saudi Arabia said it was confident that OPEC+ was right in agreeing to raise output and India posted its strongest oil consumption in 15 months.

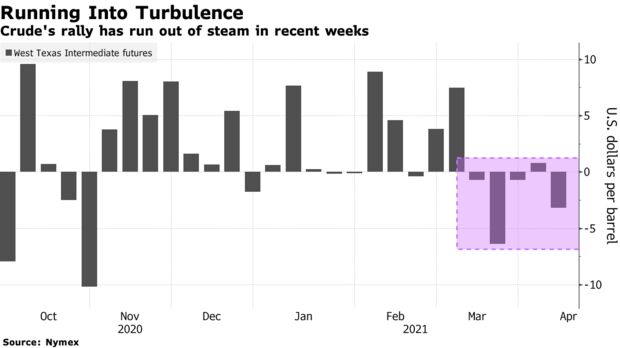

While West Texas Intermediate fluctuated, prices remain within the $5 range they’ve been holding since mid-March. India’s oil products consumption in March was the strongest since late 2019. The country’s monthly jump in gasoline demand was the biggest since 2013.

The uptick in India comes even as the country posted a record number of Covid-19 cases, with traders continuing to await a recovery in consumption elsewhere. While the roll-out of vaccines is showing signs of boosting demand in places like the U.S. and U.K., cases continue to spread rapidly in other parts of the world. Japan is set to reimpose lockdowns in Tokyo, Kyoto and Okinawa.

Saudi Arabian Energy Minister Prince Abdulaziz bin Salman said he’s yet to see anything disturbing in the market after OPEC and its allies agreed to hike output last week. While consumption continues to be patchy, the market is indicating possible supply tightness with Brent crude futures’ nearest timespread surging on Thursday.

“It has been a quiet week for the oil complex with respect to price action,” said Kevin Solomon, analyst at brokerage StoneX Group. The market’s structure has firmed as limited OPEC+ supply additions are contributing to a reduction in oil inventories, he said.

The post Saudi Arabia Confident on OPEC+ Output Hike appeared first on .